Here you want to know about EDLI scheme under EPF

The nominee or heir of the deceased member can get a maximum benefit of Rs 7 lakh under the EDLI scheme. Irrespective of the salary, the minimum insurance benefit under the scheme is Rs 2.50 lakh, if the employee has worked for 12 consecutive months

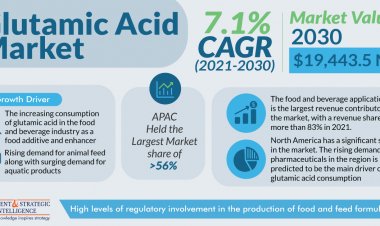

1976 The Employees' Deposit Bond Insurance Scheme (EDLI Scheme) is an insurance scheme that provides life insurance benefits to all employees who are members of the Government-backed Employees' Provident Fund (EPF) scheme, 1952. The EDLI scheme is supported by a. . Nominal contribution of 0.5% of monthly salary, up to a maximum salary limit of Rs 15,000 from employers. Employees do not make any contribution to get insurance coverage under this plan. How big is the claim, who can claim benefits under the EDLI scheme and how.

Here's what you need to know about the government-backed EDLI scheme:

Employees are not required to register separately for EDLI. Any employee who is a member of the EPF schema is automatically subscribed to the EDLI schema. EPF has three parts, apart from provident fund, a part of the employer's contribution goes to Employees' Pension Scheme (EPS) and a part goes to EDLI.

The maximum benefit under EDLI coverage is Rs 7 lakh. The minimum benefit is Rs 2.50 lakh, regardless of salary.

The employer contributes to the plan.

Insurance benefits under the EDLI scheme are available to eligible family members of the deceased member who have been in employment for more than twelve consecutive months, even if the member has worked for the same or his employer for the last twelve months. Change. his death.

Candidates, family members or legal heirs can use the EDLI scheme.

Insurance benefits under EDLI

The nominee or heir of the deceased member can get a maximum benefit of Rs 7 lakh under the EDLI scheme. Irrespective of the salary, the minimum insurance benefit under the scheme is Rs 2.50 lakh, if the employee has worked for 12 consecutive months.

As per the recent review, the insurance benefit is calculated using the following formula:

Average monthly salary earned during the last 12 months x 35 plus 50% of the average FP balance during the last 12 months, subject to a limit of Rs.1.75,000; Where, average salary means basic pay plus hunger allowance and monthly salary limit is Rs 15,000.

Whatever the formula, the minimum profit should not be less than Rs. 2.50.000.

Let us understand with an example. Suppose Raghu was earning an average monthly salary of Rs 18,000 in the 12 months before his death and the average PF balance in this period is Rs 2 lakh, then the profit in this case would be Rs 7 lakh (Rs 15,000 x Rs 35). + Rs.1). . 75,000).

Who can claim insurance benefits?

Benefit under the scheme will be paid to the candidate nominated by the employee. Enrollment in EPF scheme will be applicable to EDLI scheme also. In case of non-enrolment, his wife, unmarried daughters and minor children will be benefited.

The following family members are not eligible to claim benefits:

- children who have grown up

- the child of a deceased child who has reached adulthood

- married daughters whose husband is alive

- Married daughters of a deceased son whose husband is alive

How to claim insurance benefits?

In order to claim the insurance benefit from the nominee or the beneficiary in the event of death of the member, the member has to fill up Form 5IF. The claim form must be attested by the employer. A certified copy of the application form along with all supporting documents should be sent to the Commissioner. After the verification of the application form and supporting documents, the EDLI commissioner will pay the claim amount. The benefit amount will be deposited directly into the beneficiary's account.

The claimant needs to submit the documents provided along with Form 51F:

- employee death certificate

- Guardianship Certificate: If EDLI is claimed on behalf of a minor family member or candidate, the legal guardian will have to produce the guardianship certificate.

- Succession Certificate: If claimed by the legal heir of the employee

- Bank account details to which claim amount will be credited

/cdn.vox-cdn.com/uploads/chorus_asset/file/25115065/DCD_Avishai_Abrahami.jpg)