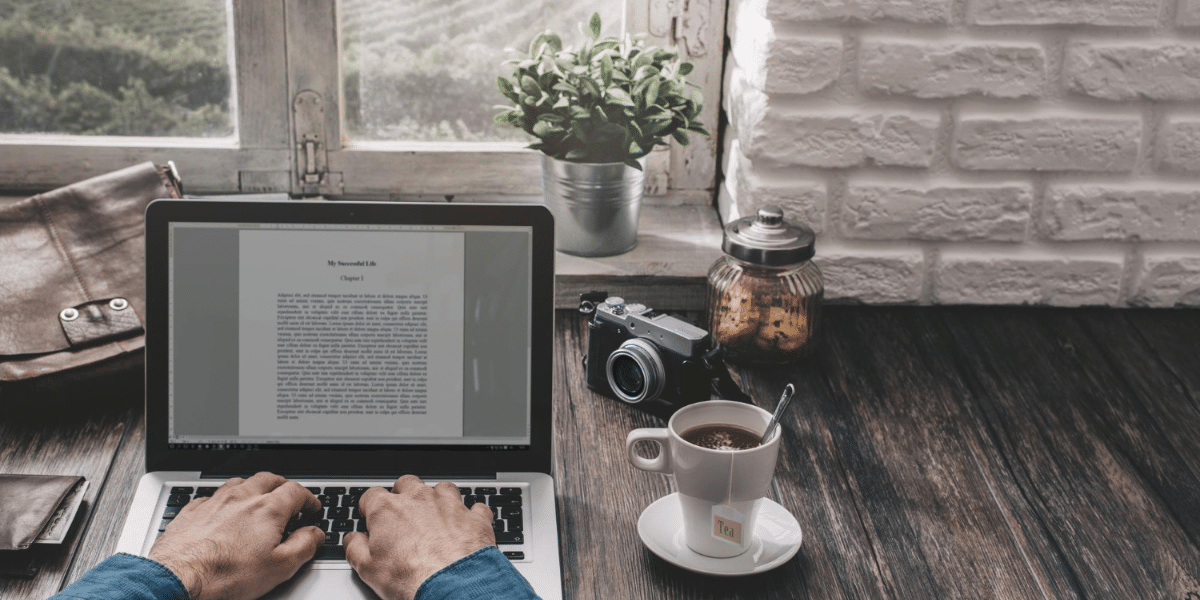

India EVSE Market Share, Size, Future Demand, and Emerging Trends

Discover key insights into the India EVSE market with our comprehensive analysis of market share, size, future demand, and emerging trends. Stay ahead in the evolving EV landscape!

Market Overview

The Indian electric vehicle supply equipment market size is estimated to have stood at USD 8.1 billion in 2024, and it is expected to reach USD 44.3 billion in 2030, with a compound annual growth rate of 32.6% during 2024–2030.

The growth of the Indian electric vehicle supply equipment market is driven by several factors, including increasing consumer preference for low-emission vehicles, growing awareness of the benefits of electric vehicles (EVs), and rising adoption rates of EVs across the country.

Government support for green vehicles and heightened public concern for environmental protection, particularly in tier-1 cities with severe air quality issues, have also fueled the demand for EVs. India ranks fifth globally for air pollution, with significant particulate matter concentration in its cities, prompting government initiatives to promote EV adoption as a means to reduce emissions from the transportation sector. This surge in EV sales is concurrently increasing the demand for EV charging stations.

Furthermore, the integration of solar energy to power these charging stations presents additional growth opportunities. India's ambitious renewable energy targets, particularly in solar power generation, underscore the potential for sustainable energy sources to meet the rising demand for EVs and their infrastructure, fostering further market expansion.

In India, the market is consolidated in nature, because of the presence of a few players. It is expected to become fragmented in the forecasted years, owing to the entry of prominent global players and numerous startups in the country.

Key Insights

- AC chargers dominate due to lower production, installation, and operational costs, making them economical for day-to-day charging.

- AC chargers preferred in both public and private sectors for efficient, faster charging capabilities and ease of installation.

- DC chargers gaining rapid adoption for their ability to deliver high voltage, efficient electricity supply, and backup power capabilities.

- Public category projected to grow at 33.0% CAGR, supported by government plans and incentives for fast-charging networks.

- Private chargers currently dominate market due to early adoption, lower cost, and high demand for home and commercial overnight charging.

- Western India (Gujarat, Maharashtra) leads with largest revenue share, driven by strong industrial base and OEM presence.

- Northern India (Delhi, Haryana, Uttar Pradesh, Punjab) expected to witness fastest growth, fueled by high air pollution levels and government initiatives.

- Eastern India (West Bengal, Bihar, Odisha) poised for significant growth due to population growth and increasing urbanization.

- Southern India (Tamil Nadu, Karnataka, Telangana) supported by favorable ecosystem for EVs, technology companies, and manufacturing hubs.

- Chennai, Hyderabad, and Bengaluru serve as key cities driving demand for EVSE in Southern India.

- Rising population and transportation needs in western India contribute to high demand for electric vehicles and charging infrastructure.

- High air pollution levels and congestion in northern Indian cities accelerate demand for EVSE to improve air quality.

- Increasing urbanization in eastern India creates substantial customer base for electric vehicles and charging infrastructure.

- Strong presence of technology companies in southern India supports growth of EVSE market, particularly in manufacturing and research sectors.

Source: P&S Intelligence

mariayardena

mariayardena

/cdn.vox-cdn.com/uploads/chorus_asset/file/25115065/DCD_Avishai_Abrahami.jpg)