EPFO Help: How to Find UAN Number Online

The Employees’ Provident Fund Organization (EPFO) is a statutory body that manages the provident fund and pension schemes of employees in India. The Universal Account Number (UAN) is a unique identification number assigned to each employee registered with the EPFO. The UAN allows employees to view and manage their provident fund account online. A recent […] The post EPFO Help: How to Find UAN Number Online appeared first on Chegg India.

The Employees’ Provident Fund Organization (EPFO) is a statutory body that manages the provident fund and pension schemes of employees in India. The Universal Account Number (UAN) is a unique identification number assigned to each employee registered with the EPFO. The UAN allows employees to view and manage their provident fund account online.

A recent report stated that more people joined the Employees’ Provident Fund Organisation in 2021-22 than ever before, with 12.2 million new enrollments. This is much higher than the number of new enrollments in previous years, indicating that many new jobs were created in the formal sector.

If you are an employee and have lost your UAN or do not know how to find your UAN number, this article will guide you through the process.

Also Read: What Is A Cancelled Cheque And How To Cancel A Cheque?

What Is a UAN Number?

The Unique Account Number (UAN) is a 12-digit code that enables access to your Employee Provident Fund (EPF) account. It provides access to multiple services linked to your EPF accounts such as balance checking, PF loan application, and withdrawal.

The EPFO assigns the UAN to you via your employer when you subscribe, and it will remain the same however you can change multiple jobs and organizations. So, in the case of job changes, EPF generates a fresh EPF account ID that links to your UAN. This prevents the need to create new PF accounts every time you switch jobs and allows for convenient viewing and reconciliation of your EPF account history.

Also Read: What is a Tax Audit?

Why Is UAN Important?

The UAN number is important because it allows an employee to access their provident fund account online. An employee can use their UAN to check their provident fund balance, download their passbook, and transfer their provident fund account from one employer to another. The UAN number also eliminates the need for an employee to obtain a new provident fund account number every time they change their employer.

Related Read: Understanding the Salary Slip

How to Find Your UAN Number?

If you have lost your UAN number or do not know your UAN number, you can find it in two ways:

Firstly, you can check your salary slips provided by your employer to find the UAN linked to your PF account. Additionally, you can also contact your company’s HR department to obtain your PF UAN number.

Alternatively, you can visit the UAN portal to find your UAN.

Step 1: Visit the EPFO Website

The first step is to visit the EPFO website, i.e., www.epfindia.gov.in.

Step 2: Click on the “Our Services” Tab

The next step is to click on the “Our Services” tab, which is located on the top menu bar.

Step 3: Click on the ‘For Employees’ Option

Once you click on the “Our Services” tab, you will see a drop-down menu. From this menu, click on the “For Employees” option.

Step 4: Click on the “Member UAN/Online Services” Option

On the “For Employees” page, you will see a section called ‘Services.’ From this section, click on the “Member UAN/Online Services” option.

Step 5: Click on the “Know Your UAN Status” option

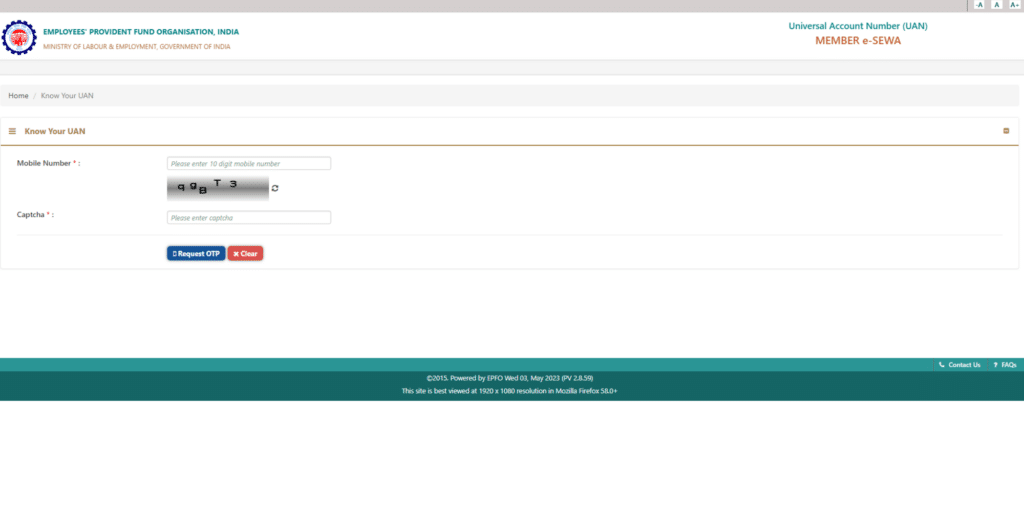

On the “Member UAN/Online Services” page, you will see various options. From these options, click on the “Know Your UAN Status” option.

Step 6: Enter your details

Once you tap the “Know Your UAN Status” option, you will be directed to a page where you will be required to enter your personal details, such as your date of birth, and mobile number. You must also input the captcha code displayed on the screen.

Step 7: Click on the “Get Authorization Pin” option

After entering your personal details, click on the “Get Authorization Pin” option. You will get an OTP (One-Time Password) on the registered mobile number.

Step 8: Enter OTP and click on the “Validate OTP and Get UAN” option

Enter the OTP you received on the registered mobile number and tap on the “Validate OTP and Get UAN” option. You will then be able to view the UAN number on the screen.

Benefits and Features of UAN

The Unique Account Number (UAN) is a powerful tool that offers several features and benefits to employees who hold a Provident Fund (PF) account. Some of the most significant features and benefits of UAN are:

Portability

The UAN stays the same for the entire career duration, even if you switch jobs. This means you don’t have to create a new PF account whenever you change your job. The UAN ensures that all your PF accounts are linked, making transferring the PF balance from one account to another more straightforward.

Multiple EPF Account Linking

UAN allows for linking multiple EPF accounts to a single UAN. This is particularly beneficial for employees who change jobs frequently. It ensures that all your PF accounts are consolidated under a single UAN, and you can easily view your entire PF account history.

SMS Services

The UAN also provides SMS services, which means you can receive SMS alerts every time there is an update in your PF account, such as balance credit or withdrawal status.

Online Claim Submission

With the help of UAN, you can now submit your PF claims online, which is a faster and more convenient process. This service ensures that you can apply for PF withdrawal or transfer quickly and efficiently, without any hassles.

Documents Required to Generate UAN

Here are the documents required to generate UAN:

- Aadhaar Card

- PAN Card

- Bank Account Number & Details

- Date of Birth Proof

- Mobile Number

- Email ID

How To Link UAN With Aadhaar?

Here’s a step-by-step guide on how to link your UAN with your Aadhaar card:

- Visit the EPFO’s official website: Go to the EPFO’s official website (www.epfindia.gov.in). Click on the “For Employees” tab on the homepage.

- Click on the “UAN Member e-Sewa” link: Under the “Services” section, click on the “UAN Member e-Sewa” link.

- Login to your account: Enter your UAN and password to log in to your account.

- Go to the “Manage” section: Once you are logged in, go to the “Manage” section. Click on the “KYC” option.

- Enter Aadhaar details: Under the KYC section, click on the “Aadhaar” option. Enter your Aadhaar number and name as mentioned on your Aadhaar card. Make sure that the details entered are correct.

- Verify Aadhaar details: Once you enter your Aadhaar details, click on the “Verify” button to verify your Aadhaar details. An OTP (One-Time Password) will be sent to the mobile number linked with your Aadhaar card. Enter the OTP to complete the verification process.

- Submit the details: After the verification process is complete, click on the “Save” button to submit the details.

- Approval by an employer: Once you submit the details, the employer will have to approve the linking of your Aadhaar card with your UAN. After the approval, your Aadhaar card will be linked with your UAN.

Key Takeaways

Maintaining a provident fund account is a great way to accumulate savings for your retirement, while also benefiting from free insurance coverage and various other perks. Moreover, withdrawals from your PF account are tax-exempt once you have completed 5 years of employment in a company.

It is important to know your UAN and keep your UAN updated to take advantage of these benefits, as this unique number is required for online withdrawals from the PF account. As a Q&A expert, you can earn money by sharing your knowledge and expertise with students on Chegg. Sign up today to start answering questions and earning extra income!

And for more career tips and useful information view our more blogs on Life Skills.

Frequently Asked Questions on UAN Number

To get your UAN number online, visit the official website of the Employees’ Provident Fund Organisation (EPFO) and click on the ‘Activate UAN’ option. You will need to provide your personal details, such as your name, mobile number, and email ID, to register and receive your UAN.

You can know your UAN number by SMS by sending an SMS to the designated EPFO number from your registered mobile number. The SMS should be in the format EPFOHO UAN TEL, where TEL refers to the language in which you want to receive the message.

To know your UAN number by mobile number, you can call the toll-free number of the EPFO and provide your personal details, such as your date of birth, name, name, and mobile number. Alternatively, you can also visit the EPFO site and click on the ‘Know Your UAN’ option.

Other Useful Resources

The post EPFO Help: How to Find UAN Number Online appeared first on Chegg India.