Crowdfunding for Startups: Top Platforms & Benefits

Who would’ve thought that one day you could make your customers investors? Crowdfunding for startups has made that possible. Now, you can go out in public, tell them about your business idea or cause, and raise money. It’s like the Shark Tank in open water. Don’t think of it as some new trend that’ll vanish […] The post Crowdfunding for Startups: Top Platforms & Benefits appeared first on Chegg India.

Who would’ve thought that one day you could make your customers investors? Crowdfunding for startups has made that possible. Now, you can go out in public, tell them about your business idea or cause, and raise money. It’s like the Shark Tank in open water.

Don’t think of it as some new trend that’ll vanish away when something new comes up. Since the finacial crisis of 2008, crowdfunding for startups has shown an upward trend and it’s estimated to have a global market volume of $1.27 billion by 2028.

If you have a business idea or a cause you want to support, and you want people to be a part of it as investors, then this guide is for you. You’ll know the meaning of crowdfunding, popular platforms to get funded, and different types of crowdfunding.

Rest assured, by the end of this guide, you’ll have a clear understanding of how crowdfunding works. So, without further ado, let’s begin with the most important question…

What is Crowdfunding?

Crowdfunding is raising small amounts of money from a large number of people. It is done mainly using social media and crowdfunding websites like Kickstarters, IndieGogo, and GoFundMe. The minimum investment in crowdfunding for startups could be as low as $10.

The first crowdfunding was done by a music group in the United Kingdom in 1997 for a concert tour. In 2000, the first crowdfunding website was launched called ArtistShare. The website became primary source of crowdfunding for entrepreneurs almost a decade later.

After the financial crisis of 2008, banks introduced strict policies for money lending. Small businesses that wanted credit were unable to get it. That’s when crowdfunding gained traction as an alternative source of credit and capital.

In 2023, the global market volume of crowdfunding was estimated at $1.17 billion, and it is expected to grow by 1.48% every year.

Crowdfunding campaigns runs on, and build a, community around the project. The entrepreneurs provide clear information about their projects which every investor can read and examine. Investors can see how much money has the project raised. Crowdfunding platforms for startups earn money by keeping a small percentage of the money raised.

Crowdfunding is particularly beneficial for small businesses and startups who want to build a community and have the people directly engaged with the product. It’s an easy source for capital as compared to bank loans and angel rounds.

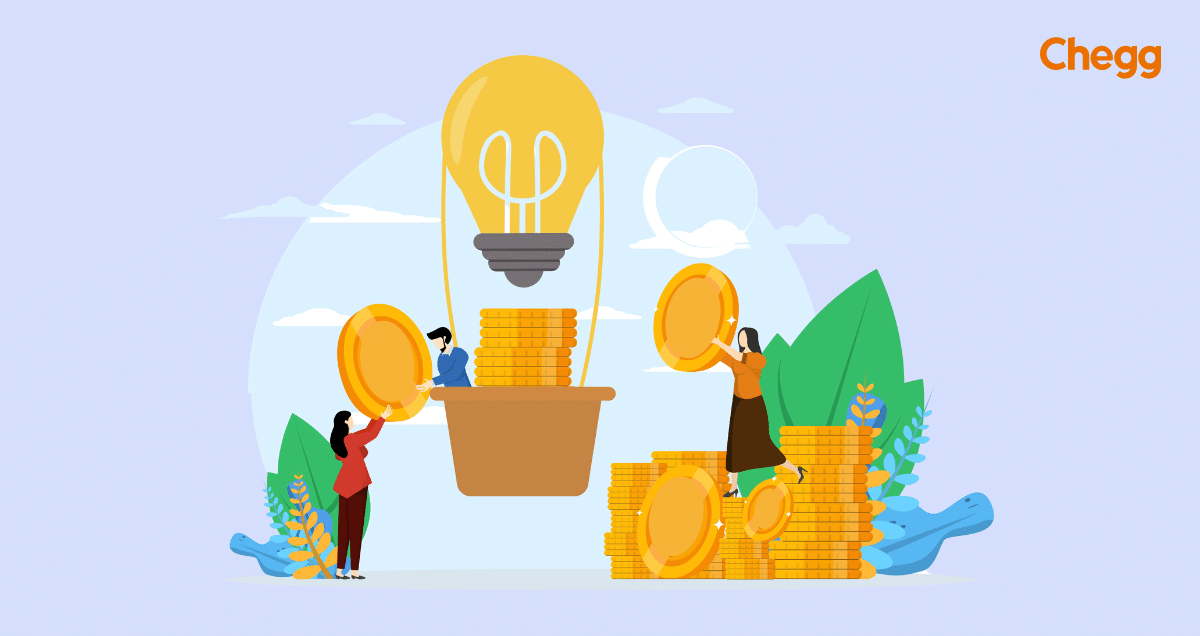

The Benefits of Crowdfunding for Startups

For startups, crowdfunding offers a new way to raise money and connect with potential customers. It gives you access to funding and creates a community that is supportive of your initiative. Crowdfunding for startups offers several key benefits:

- Access to Capital: Startups can raise funds without relying on traditional loans or investments. This helps business owners who may struggle to get bank or venture capitalist funding.

- Market Validation: Through crowdfunding, entrepreneurs can present their concept or product to possible investors. This measures interest besides aiding in fundraising. Supporters’ comments can be very helpful in improving the goods or services.

- Brand Exposure and Community Building: An effective crowdsourcing campaign can greatly raise the profile of a firm. It also facilitates the development of a devoted clientele. Early backers often become brand ambassadors. They promote the startup and help others learn about it.

- Case Study: Aditya Iyer, an author, raised around $14000 through online crowdfunding to publish his maiden book, “The Great Indian Obsession: The Untold Story of India’s Engineers”.

Crowdfunding for Specific Startup Sectors

Crowdfunding provides various advantages across different sectors, particularly for tech and software startups. Understanding the unique aspects of these sectors can help you leverage crowdfunding effectively.

Here’s a closer look at how crowdfunding works for tech and software startups, along with examples and platform recommendations.

Crowdfunding for Tech Startups

Crowdfunding for tech startups comes with unique challenges and opportunities:

- Challenges: Tech startups often face high development costs and need to showcase a working prototype or beta version. Potential backers want proof that your technology is viable and can deliver on its promises.

- Opportunities: Crowdfunding allows you to tap into a community of early adopters who are excited about new technology. It helps you build a loyal following and gather valuable feedback, which can be crucial for refining your product.

Examples

- Pebble Watch: This smartwatch set a crowdfunding record, raising over $10 million on Kickstarter. It demonstrated the power of having a clear vision and a functional prototype to attract massive support.

- Oculus Rift: The virtual reality headset raised $2.4 million on Kickstarter. This campaign showed how crowdfunding can bring groundbreaking technology to market by engaging a passionate community.

Crowdfunding for Software Startups

Crowdfunding is also effective for software projects:

- Funding Development: Crowdfunding can be used to finance the development of new software. Offer backers early access or exclusive features to entice them to support your project.

- Community Engagement: Engage with early users who can test your software and provide feedback. This helps you improve the product before its official release and build a community around it.

Platform Recommendations

Here’s a couple of good platforms you can use for Crowdfunding for software startups:

- Kickstarter: Great for both tech and software projects. It has a large audience and is ideal for rewards-based crowdfunding.

- Indiegogo: Offers flexible funding options and suits various software projects. It allows you to keep the funds raised even if you don’t hit your goal.

Crowdfunding Loans for Startups

Startups can also use crowdfunding to secure loans:

- Platforms: Kiva and Funding Circle are known for loan-based crowdfunding. They connect startups with lenders willing to provide capital in exchange for repayment with interest.

- How It Works: Present your business plan and funding needs. Lenders provide the capital, and you repay it over time, often with interest.

Types of Crowdfunding for Startups

Crowdfunding offers various models, each suited to different business needs and goals. Understanding these types can help you choose the best approach for your startup. Here’s an overview of the main crowdfunding models and how they work.

Equity Crowdfunding

Equity crowdfunding lets startups offer shares of their company in exchange for funding.

- Benefits: This model provides access to a large pool of investors. It helps you raise significant capital and gain long-term investors who are invested in your company’s success.

- Drawbacks: Offering equity means giving up a share of your company. It can lead to complex investor relations and potential loss of control.

Suitable for: Businesses seeking long-term investors interested in owning a part of the company.

Reward-Based Crowdfunding

Reward-based crowdfunding involves offering products or services as rewards to backers.

- Benefits: This model is popular among startups, especially in creative and tech fields, because it allows you to fund your project without giving away equity. Backers get a tangible reward, which can build excitement and engagement.

- Examples: Many successful projects have launched on platforms like Kickstarter and Indiegogo. These platforms are known for their strong communities and support for innovative ideas.

Suitable for: Startups looking to pre-sell products or services and build a community around their brand.

Debt Crowdfunding (Crowdfunding Loans)

Debt crowdfunding allows startups to obtain loans from multiple investors and repay them with interest.

- Benefits: There’s no equity dilution, meaning you retain full ownership of your company. Loans usually come with fixed repayment terms, which helps with financial planning.

Suitable for: Startups needing capital without giving up ownership.

Donation-Based Crowdfunding

Donation-based crowdfunding is often used for social causes and nonprofit projects.

- Benefits: It’s ideal for healthcare startups and community-driven initiatives looking to raise funds for a cause rather than a business venture.

Suitable for: Projects focused on social impact and charitable goals.

Hybrid Models

Some platforms offer a combination of these models, providing flexibility for startups.

- Benefits: Hybrid models allow you to choose the best approach for your needs, combining elements of equity, rewards, and loans to fit different funding strategies.

Top Crowdfunding Platforms for Startups

Choosing the right crowdfunding platform is crucial for your startup’s success. Each platform offers unique features and caters to different industries. Here’s a look at some of the top platforms for startups and what they have to offer.

Kickstarter and Indiegogo

Kickstarter and Indiegogo are among the most popular crowdfunding platforms, supporting a wide range of projects.

Kickstarter:

Kickstarter is known for its strong community and focus on creative and tech projects.

-

Pros:

- Large, active community.

- Ideal for creative and tech projects.

- All-or-nothing funding model ensures you reach your goal or receive nothing.

-

Cons:

- Higher platform fees, around 5% plus payment processing fees.

- The all-or-nothing model can be risky if you don’t meet your goal.

Indiegogo:

Indiegogo offers flexible funding options and a broad range of project types.

-

Pros:

- Flexible funding options (keep funds even if you don’t meet your goal).

- Wide range of project types accepted.

- Global reach and diverse funding options.

-

Cons:

- Platform fees similar to Kickstarter.

- The flexible funding option might reduce urgency among backers.

Crowdfunding for Startups in India

Indian startups can benefit from platforms like Ketto and Wishberry, which offer localized support.

Ketto:

Ketto specializes in social causes and healthcare projects in India.

-

Pros:

- Focus on social and healthcare projects.

- No platform fees for nonprofit campaigns.

- Strong network within India for impactful projects.

-

Cons:

- Limited international reach compared to global platforms.

Wishberry:

Wishberry is tailored for creative projects and startups in India.

-

Pros:

- Specializes in creative projects and Indian startups.

- Personalized campaign support and guidance.

- Community-driven focus with Indian investors.

-

Cons:

- Smaller audience compared to global platforms.

Success Stories

Several successful campaigns highlight the effectiveness of these platforms:

- Kickstarter: The Pebble Watch raised over $10 million, demonstrating Kickstarter’s strength in launching innovative tech products.

- Indiegogo: The Coolest Cooler raised $13 million, showcasing Indiegogo’s ability to support consumer products.

- Ketto: The campaign for the Indian movie “Bharat” successfully raised substantial funds, reflecting Ketto’s strength in creative and impactful projects.

Crowdfunding for Healthcare Startups

Platforms like MedStartr cater specifically to healthcare startups, offering tailored support.

MedStartr:

MedStartr focuses on medical innovations and healthcare solutions.

-

Pros:

- Tailored for healthcare and medical innovations.

- Access to industry-specific backers and experts.

- Offers a platform designed for medical projects.

-

Cons:

- Limited visibility for non-healthcare projects.

- Specific to healthcare, which might not suit other sectors.

Each platform has unique features that make it suitable for different types of startups. Choosing the right one can help you effectively achieve your funding goals and connect with the right audience.

How to Choose the Best Crowdfunding Platform

Selecting the best crowdfunding platform is essential to your startup’s success. When making this choice, consider many aspects. They will ensure the platform fits your goals and business needs.

Factors to Consider

- Fees: Fees from various platforms vary. They include campaign management costs, platform fees, and payment processing fees. It’s critical to know these expenses and their impact on your financing.

- Audience: Take into account the platform’s target audience. Some platforms target specific industries or demographics. They may help if your firm aligns with their priorities.

- Platform Reach: A platform’s extensive geographical presence significantly influences campaign outcomes. You can expand your financing pool by attracting global backers. Use platforms with a worldwide readership to do this.

- Industry Focus: Certain platforms focus on specific sectors, such technology, healthcare, or creative endeavours. Choose a platform that suits your sector. It will help you succeed.

Crowdfunding Websites for Startups

- Kickstarter: Perfect for IT and creative startups. It has a significant, active viewership and a strong sense of community. Ideal for initiatives that may excite participants and provide real benefits.

- Indiegogo: It suits many ventures, including tech, creative, and social impact projects. It offers flexible funding options. It is available everywhere and accepts a variety of currencies.

- Crowd Supply: Particularly serves hardware and technology projects. It is famous for its successful, innovative digital products. It also offers extra help, like fulfilment services.

- Ketto: Ideal for Indian companies, particularly those involved in social and healthcare issues. It prioritises impact-driven projects and provides specific guidance.

Tech and Software Startups

Crowd Supply: Particularly serves hardware and technology projects. It is known for its successful, innovative digital products. It also offers fulfilment services.

Platform Comparison

| Platform | Industry Focus | Fees | Global Reach | Best For |

| Kickstarter | Creative, Tech | 5% + payment fees | High | Innovative products |

| Indiegogo | Tech, Creative, Social | 5% + payment fees | High | Flexible funding needs |

| Crowd Supply | Technology, Hardware | 5% + payment fees | Medium | Tech and hardware startups |

| Ketto | Healthcare, Social Impact | 0% for nonprofits | Low-Medium | Indian startups, healthcare |

How to Get Started with Crowdfunding For A Startup?

Starting a crowdsourcing project requires proper preparation and handling. It’s vital to follow some steps. They will help your startup attract investors.

Pre-Campaign Planning

- Set Clear Goals: Specify your needs on the amount of money and its intended purpose. Defined financial objectives ease understanding of your demands and success metrics by supporters.

- Define Your Audience: Determine which people are most likely to back your campaign. Recognise their preferences and areas of interest to successfully adapt your message.

- Create a Compelling Campaign Story: Write a story. It should outline your startup’s goals, the problem you solve, and what makes your effort unique. A compelling story draws in potential supporters and motivates them to give.

Campaign Execution

- Create Engaging Content: To best represent your project, include thorough explanations, videos, and high-quality photos. Rich, eye-catching content can draw in more supporters.

- Leverage Social Media: Distribute the word about your campaign on social media. Use hashtags, interact with followers, and share updates to reach a larger audience.

- Maintain Communication with Backers: Update backers often to keep them updated. To build confidence and sustain attention, quickly address their queries and remarks.

Post-Campaign Follow-Up

- Fulfil Promises: Fulfil the incentives or benefits you promised to offer during the campaign. Timely fulfilment helps you build credibility and trust with your backers.

- Keep Backers Updated: Give regular updates on how your project is coming along. Openness helps keep supporters on board and readies them for more communication.

- Leverage Success for Future Funding: Use your campaign’s successes as a case study for upcoming fundraisers. Promote successful results and acquired knowledge to draw in fresh investors.

Tips for Startups

- Plan Thoroughly: Spend time organising each aspect of your campaign. A campaign with proper planning has a higher chance of success.

- Engage Early: Before launching, generate support and interest. Engagement before launch might give your campaign momentum.

- Be Authentic: Authenticity appeals to supporters. Express your genuine enthusiasm and dedication for your project.

- Check and Adapt: Check your campaign’s effectiveness and be ready to adjust your strategies as needed. Remain adaptable and receptive to criticism.

Follow these guidelines. They will help you start and run a crowdfunding campaign. That will improve your chances of success.

Begin Your Business With Community Support

Crowdfunding for startups offers a powerful way to raise capital, validate market interest, and build a loyal community. By understanding the various types, benefits, and strategies, you can effectively use crowdfunding to achieve your funding goals.

Explore platforms like Kickstarter, Indiegogo, and specialized sites to find the best fit for your project. As crowdfunding continues to evolve, it holds immense potential to revolutionize how startups secure financing. Dive into this dynamic funding option and watch your startup thrive! For more information, check out the recommended platforms and start your crowdfunding journey today.

What are the best crowdfunding platforms for startups?

Indiegogo and Kickstarter are the top crowdfunding sites for companies. Kickstarter is great for tech and creative projects. It has a large, active audience. Indiegogo’s global reach and diverse fundraising options make it a great platform for many projects. Crowd Supply is highly recommended for tech firms. It emphasizes hardware and technology.

How can startups benefit from crowdfunding?

Startups can benefit from crowdfunding by accessing capital without traditional loans or investors. It helps validate market interest and builds a supportive community around the project. Crowdfunding also offers increased visibility and can turn early backers into brand advocates, enhancing both funding and marketing efforts.

What is the difference between equity crowdfunding and rewards-based crowdfunding?

Equity crowdfunding involves raising funds by offering shares in the company. Investors gain ownership and potential financial returns. Rewards-based crowdfunding provides backers with non-financial rewards, such as products or services, instead of equity. It’s a way to raise funds without giving up ownership or control of the company.

How can healthcare startups leverage crowdfunding?

Healthcare startups can leverage crowdfunding by using platforms specialized in medical and health innovations, like MedStartr. Crowdfunding helps them raise funds for research, product development, and clinical trials. It also engages potential users and stakeholders, offering early validation and support for their medical solutions.

What should tech startups consider when choosing a crowdfunding platform?

Tech startups ought to take a look at Crowd Supply and other platforms that concentrate on hardware and technology. They should assess the platform’s costs, coverage, and capacity to meet its tech requirements. Make sure the platform has a vibrant community of tech enthusiasts and supports interesting content as well.

Also Read:

Angel Investors: What Is Angel Investing & How Does It Work?

The post Crowdfunding for Startups: Top Platforms & Benefits appeared first on Chegg India.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25115065/DCD_Avishai_Abrahami.jpg)