Reverse Logistics Market Will Reach USD 1,431.8 Billion By 2030

Discover how the Reverse Logistics market is poised to reach USD 1,431.8 billion by 2030. Stay ahead of the curve!

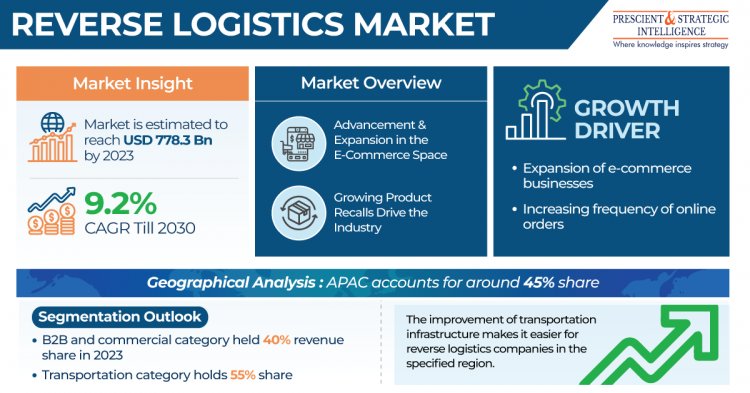

In 2023, the worldwide reverse logistics market generated USD 778.3 billion in revenue. It is anticipated to experience a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030, reaching USD 1,431.8 billion by 2030. This growth can be credited to the growth of e-commerce industries and the growing occurrence of online orders with the increasing count of returns and replacement of items.

Market Drivers

- Increasing Stringent Regulations and Safety Concerns: More and more harsh regulations showing product safety and quality concerns will be implemented. As this factor increases the rate of product recalls it will influence positively the market size.

- Advancements in Logistics and Supply Chain: The fact that the field of logistics and supply chains is under the influence of continuous change in technology and robotics is a special characteristic of the industry, driving the logistics sector demand which makes the need for reverse logistics services.

- Enhanced Transportation Infrastructure: Advancement in transportation means that transporting the companies of reverse logistics companies between different regions is now made easy, which also makes the market progress.

- Growth of E-commerce and Globalization: The ever-increasing demand for e-commerce, cross-border trade, and globalization are seen to be the major fuels that carry the preoccupation for returnable items and reverse supply chains.

- Rising Product Recalls Due to Regulatory Compliance: Tight government regulations and policies in industrial sections like automotive, healthcare, and retail have resulted in an increased number of products being recalled which further fuels the mind of reverse logistics services.

- Automotive Sector Regulations: The automotive industry is encountering regulations because of safety concerns and producing defective ones from poor-quality stuff causes accidents and deaths that in turn cue the strict laws and provide a demand for reverse logistics services.

B2B and Commercial Category Is Dominating the Market

In 2023, on the basis of return type, the B2B and commercial category had the largest industry share, of 40%, and the category is also projected to endure its leading position over the projection period. B2B and commercial returns denote the return between the vendor and the manufacturer.

- Merchandise is often returned in large quantities when defective or damaged items are received, with commercial platforms providing return and exchange services for specific products, leading to substantial growth in B2B and commercial returns within the market.

- The repairable category is forecasted to experience the highest growth rate, with a CAGR of 10%, during the expected timeframe.

- The expansion of the market is facilitated by the growing trend of cross-border trade, which has opened up new opportunities and avenues for growth within the industry.

Transportation Category Is Generating Largest Revenue Share

In 2023, based on service, the transportation category generated the largest revenue share, of around 55%, and the category is also projected to continue with dominance over the projection period.

The transportation system is the most critical part of the logistics and supply chain. The same transportation system, which ships the products to consumers, also deals with customer returns for material replacement, backhauling, and repair.

Asia-Pacific Is the Main Source of Revenue for The Industry

In 2023, the APAC region is dominating with around 45%, market share, and the regional sector is projected to witness a robust CAGR over the forecast period as well.

- The substantial revenue generation from the APAC region is credited to many reasons, such as the rise in retail sales, constant launches of pioneering electronic items, and strong government guidelines targeted at curbing the sale of dangerous and fake goods to customers.

- India's e-commerce industry is witnessing quick development, with a noteworthy surge in online buyers. For instance, data from the India Brand Equity Foundation reveals that the country has gained 125 million online shoppers in the last three years, and an additional 80 million are anticipated to join the online market by 2025.

Source: P&S Intelligence

mariayardena

mariayardena

/cdn.vox-cdn.com/uploads/chorus_asset/file/25115065/DCD_Avishai_Abrahami.jpg)